Investment Guide for Commercial and Industrial Solar Plant in Thailand

Driven by the comprehensive advancement of the Belt and Road Initiative and the deepening of the China-ASEAN Free Trade Area, Chinese enterprises are accelerating their globalization. An increasing number of Chinese companies are choosing Thailand as a key destination for overseas investment. Through a series of signed trade agreements, China and Thailand continue to deepen their economic and trade cooperation. As member states of the Regional Comprehensive Economic Partnership Agreement (RCEP), both sides can fully benefit from the trade facilitation provided by the agreement. According to data released by China's General Administration of Customs, the total bilateral trade value between China and Thailand in 2024 reached USD 133.98 billion, a year-on-year increase of 6.1%. Thailand is an important trading partner for China in Southeast Asia, and China has remained Thailand's largest trading partner for 12 consecutive years.

I. Thailand's Foreign Investment Regulatory Framework and Incentive Policies

1. Introduction to BOI and Related Incentive Policies

The core authority overseeing foreign investment in Thailand is the Board of Investment (BOI). Established in 1966 under the Investment Promotion Act, the BOI is a government agency directly under the Office of the Prime Minister. Its main responsibilities are to formulate investment promotion incentives and provide assistance services to investors. Foreign investment entities that pass the BOI review and obtain an Investment Promotion Certificate can enjoy policy benefits such as tax reductions or exemptions, land ownership rights, and facilitation for employing foreign workers.

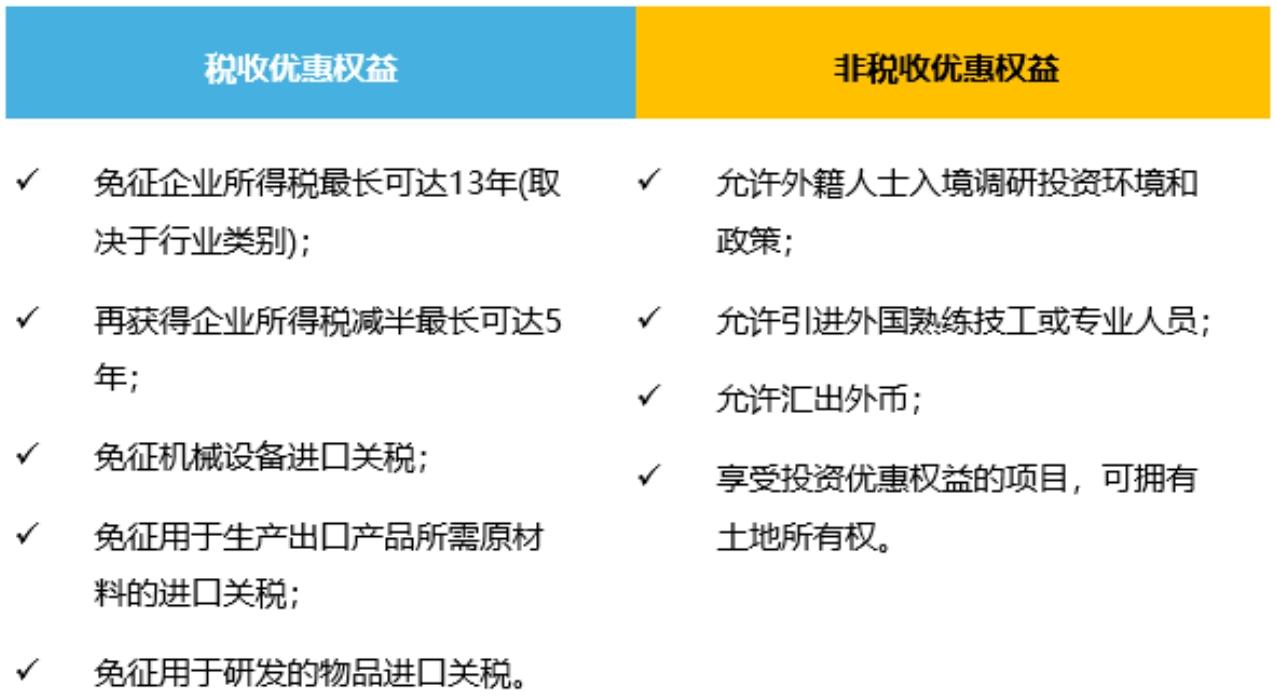

The BOI categorizes eligible activities into six tiers based on industry type and strategic importance: A1+, A1, A2, A3, A4, and B. Projects in the highest tier, A1+, can enjoy a corporate income tax exemption for up to 13 years. BOI incentives can be divided into tax incentives and non-tax incentives, as illustrated below:

2. Introduction to IEAT and Related Incentive Policies

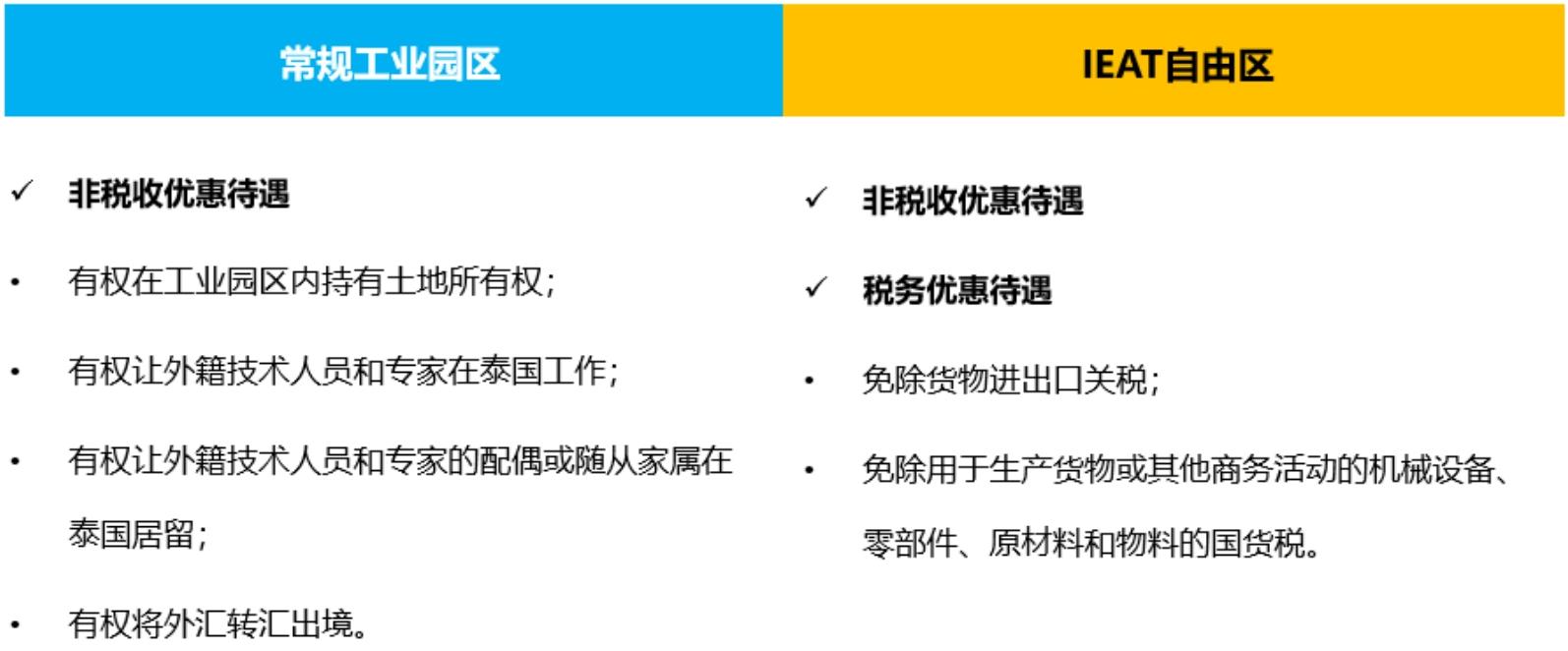

The Industrial Estate Authority of Thailand (IEAT) is responsible for land leasing and management within industrial estates. To attract foreign investment, IEAT provides a range of incentive policies, including both tax and non-tax benefits. IEAT industrial estates are categorized into General Industrial Zones (GIZ) and IEAT Free Zones (IFZ). The incentives differ between the two: both GIZ and IFZ can enjoy non-tax incentives, while IFZs are eligible for additional tax incentives.

Furthermore, the Department of Business Development (DBD) under the Ministry of Commerce is also responsible for part of foreign investment administration, including the registration of business organizations and approving foreign business licenses for restricted activities.

The Foreign Business Act (FBA) is a key regulation governing foreign investment in Thailand. It defines the scope, conditions, and procedures for foreign business operations, providing clear legal guidance for investors. The FBA defines "foreigners" as:

·Natural persons not of Thai nationality, or juristic persons not registered in Thailand;

·Juristic persons registered in Thailand with 50% or more of their shares held by foreign natural persons or juristic persons;

·Partnerships (including ordinary and limited partnerships) where the capital share or investment amount held by foreigners exceeds 50%, or where the managing partner or manager is a foreigner.

II. Forms of Business Organization for Foreign Investment in Thailand

1. Private Limited Company

·Requires a minimum of 2 promoters during incorporation, each holding at least 1 share with a par value of at least 5 Thai Baht.

·For businesses not in restricted sectors, the minimum registered capital is 2 million Thai Baht (approx. RMB 400,000). For restricted sectors, the minimum is 3 million Thai Baht (approx. RMB 600,000). At least 25% of the registered capital must be paid up upon company registration.

·Requires at least 1 director, who can be a foreigner. Directors are not required to reside in Thailand.

·Requires articles of association defining the corporate governance structure and operational rules to ensure standardized operations.

2. Partnership

·An ordinary partnership requires at least two partners, each contributing capital in the form of money, other property, or services. All partners bear unlimited joint liability for the partnership's debts.

·A limited partnership consists of unlimited liability partners and limited liability partners. Limited partners can only contribute money or other property. Limited partners are liable only to the extent of their capital contribution, while unlimited partners bear unlimited joint liability for the partnership's debts.

3. Branch Office

·A branch office is part of the same legal entity as its overseas headquarters.

·A foreign branch is also considered a "foreigner" under the FBA. To engage in restricted business activities, it must obtain a Foreign Business License (FBL) or Foreign Business Certificate (FBC).

4. Representative Office

·A representative office of a foreign company in Thailand cannot engage in profit-generating activities. Its scope is limited to providing support services for its head office, such as market research and client liaison, to reduce operational costs and risks.

·It does not require an FBL or FBC.

·For regulatory purposes, a representative office must apply for a registration number and notify the Ministry of Commerce of its operating location in Thailand.

III. Investment in the Renewable Energy Sector

1. Regulators & Key Market Operators

Thailand's power market regulators mainly include the Ministry of Energy, the Energy Policy and Planning Office, and the Energy Regulatory Commission. They are responsible for formulating power policies, implementation, and overseeing power market operations, respectively.

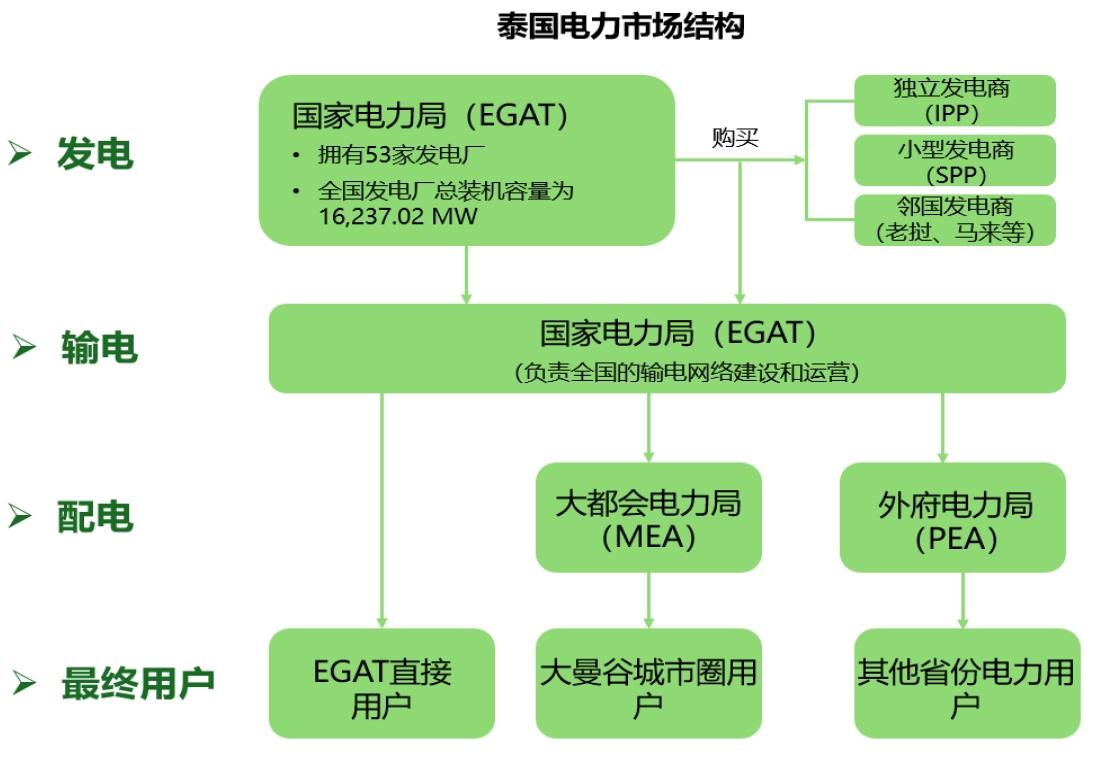

Furthermore, there are three main operators in the Thai power market: the Electricity Generating Authority of Thailand (EGAT), the Metropolitan Electricity Authority (MEA), and the Provincial Electricity Authority (PEA).

— EGAT is Thailand's largest power generation enterprise, under the Ministry of Energy and the Ministry of Finance, responsible for most of the nation's electricity generation.

— MEA is primarily responsible for electricity distribution and retail services in the Bangkok metropolitan area.

— PEA is mainly responsible for supplying and distributing electricity to users in remote areas across 74 provinces (excluding the MEA's jurisdiction).

2. Investment Incentive Policies

According to the 2023 Guidelines for Applications for Investment Promotion, businesses engaged in electricity or steam production using renewable energy (solar, wind, biofuels, or biogas) and those manufacturing solar cells and/or raw materials for solar cells are classified under the "A2" category. The BOI offers them an 8-year corporate income tax exemption. Additionally, machinery imported for renewable energy production, materials for R&D, and raw materials or essential materials used in manufacturing export products are exempt from import duties.

Regarding non-tax incentives, BOI-approved renewable energy projects can obtain land ownership rights, which is crucial for large-scale project construction. They are also allowed to hire foreign employees without ratio restrictions, facilitating the introduction of advanced technology and management expertise. Furthermore, they enjoy greater freedom in remitting foreign exchange abroad, ensuring investor liquidity.

3. Foreign Investment Restrictions

【Restrictions on Power Generators under FiT Schemes】

·Must be a juristic entity established under Thai law, or a business registered in Thailand.

·If a limited company, foreign shareholders (ultimate shareholders) cannot hold more than 49% of the total shares, and the number of foreign shareholders cannot exceed half of the total number of shareholders.

·More than half of the board members and persons authorized to sign company documents must hold Thai nationality.

·Exemptions: Cases stipulated by special international agreements granting national treatment, or other legal exemptions.

【Restrictions on Foreign Investment in New Energy Project Construction】

·Construction business falls under the FBA's negative list as "businesses where Thais are not yet ready to compete with foreigners." It is prohibited unless a Foreign Business License (FBL) or Foreign Business Certificate (FBC) is obtained. If a new energy project involves construction work, foreign investment is subject to this restriction.

·Exemptions: Obtaining an FBL/FBC; cases under treaties signed or adhered to by Thailand; obtaining BOI promotion; obtaining IEAT permission.

【Restrictions on Foreign Land Ownership】

·Companies with more than 49% foreign shareholding of registered capital or more than half of the shareholders being foreigners are generally prohibited from owning land.

·Exemptions: Bringing in investment of not less than 40 million Thai Baht from abroad, invested in Thai government bonds, state enterprise bonds, real estate funds, or in BOI-promoted enterprises for a period of not less than five years; obtaining BOI promotion; obtaining IEAT permission.

IV. Conclusion

Thailand possesses abundant solar resources, with most regions averaging over 2,000 hours of annual sunshine. The northeastern region, in particular, offers superior sunlight conditions.

The rapid development of Thailand's solar power industry relies on strong government policy support and active participation from enterprises. Through measures such as formulating incentive policies, providing subsidies, and streamlining approval processes, the government has created a favorable environment for the industry's growth. Concurrently, the Thai government promotes infrastructure development and operation in the solar power sector through bidding projects.